The Billions vs. the Billionaires

Introducing Zeteo’s new column on economics and politics from acclaimed British commentator and author Grace Blakeley.

First, a note from Mehdi about Zeteo’s new column:

Grace Blakeley, the British writer and author, is a force of nature! Informed, passionate, eloquent (have you seen her spar with Piers Morgan? Or on ‘Question Time’?), I have been a fan of hers for several years now and am delighted to announce her as Zeteo’s new contributor on politics, economics, and finance. Her column and newsletter, ‘Billions by Grace Blakeley,’ will highlight both the vast amounts of power and wealth held by the billionaires and the billions of exploited people in a position to fight back. And if you’re not yet a paid subscriber to Zeteo, what are you waiting for? Subscribe now, and read Grace’s column, in full, below.

- Mehdi

For the last several decades, we’ve all put up with increasing inequality because we believed the billionaires were creating wealth for all of us. Like manipulative partners, the super-wealthy have legitimized an extremely unequal economic model by convincing us that we’d be worse off without them.

The parasitic role of the super-wealthy became very obvious after the financial crisis, when billionaires nearly destroyed the global economy only to be bailed out by client governments who spent the next decade cutting social security and other social programs while providing handouts to the rich.

Then came the COVID-19 pandemic, when some of the largest corporations on the planet received government support while ordinary workers lost their jobs and their homes. And then came the cost of living crisis, when powerful corporations used inflation as an excuse to raise prices, delivering huge profits at the expense of consumers.

Today, the jig is up. It’s become increasingly clear that the billionaire class – whose wealth, according to Oxfam, grew three times faster in 2024 than the previous year – is made up of takers, not makers.

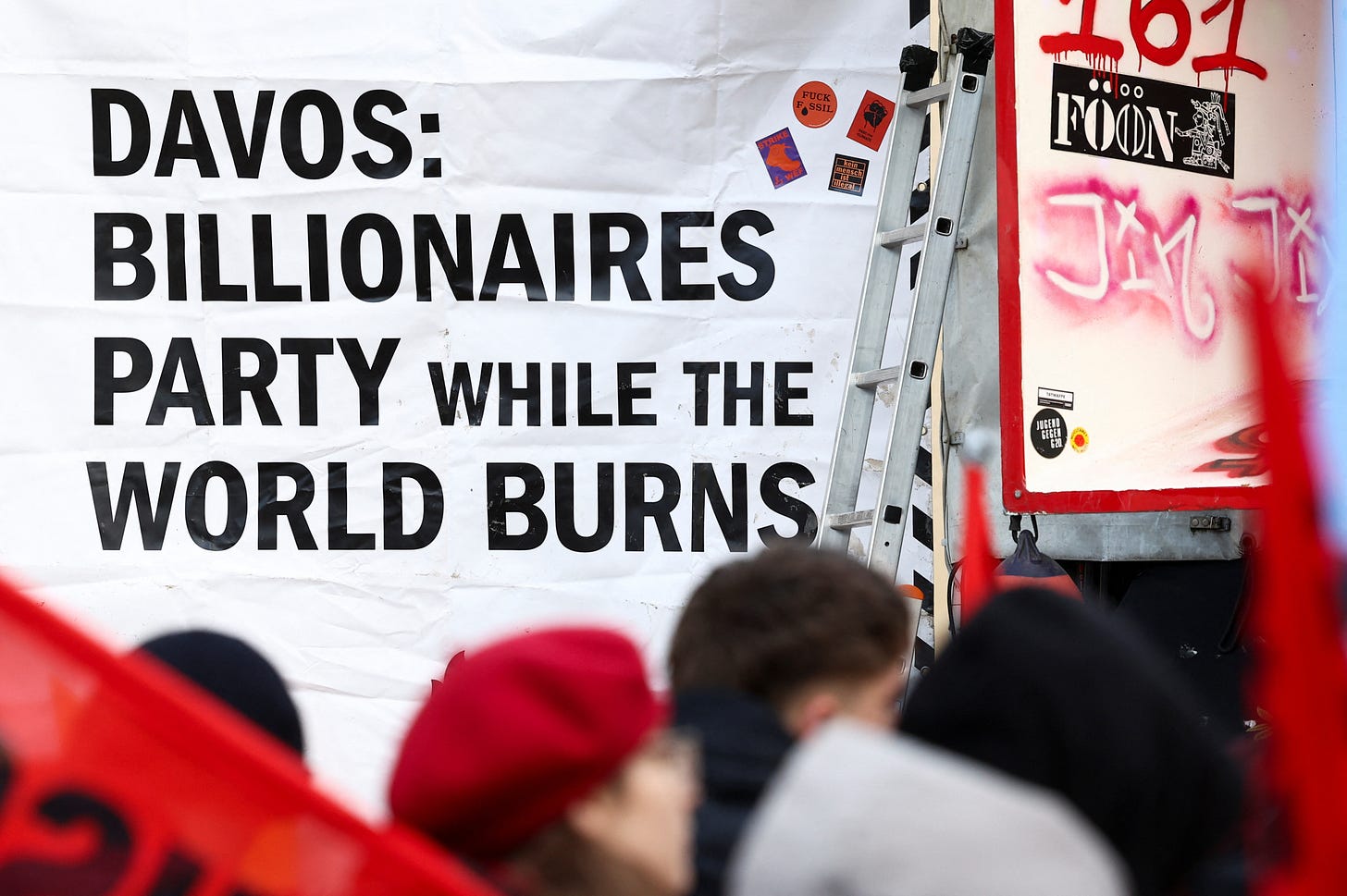

As the general public has become less accepting of extreme inequality, the billionaire class has had to come up with new ways to legitimize their wealth and power. And Davos, where some of the world’s most powerful people are gathering this week, is one of the main settings in which they’ve tried to work out how to do this.

Capitalist Planning

The discussions taking place at the World Economic Forum’s annual meeting in Davos provide the perfect example of what I call ‘capitalist planning.’

As I explain in my book, Vulture Capitalism, capitalism isn’t actually a free market system – it’s a system dominated by corporate monopolies with extremely close links to the state. Far from being buffeted by the forces of free market competition, large corporations and powerful governments can work together to plan who gets what.

At Davos, the individuals and institutions with the most power within global capitalism come together to determine how best to profit from current trends in the world economy. And, in recent years, they’ve also used Davos as a setting to discuss how to sell their profit-making strategies to everyone else.

For a while, they leaned heavily on the idea of green, ethical capitalism. During the mid-2010s, when left-wing movements seeking to take on the billionaires were at their strongest, Davos’ panels had titles like ‘Safeguarding Our Planet’ and ‘Towards Better Capitalism.’

At the forefront of these initiatives were the world’s largest financial institutions. Asset managers like Blackrock, who manage trillions of dollars worth of other people's savings, sought to push the narrative that they were “responsible investors” who would enforce stringent targets around sustainability and inclusivity on the corporations in which they invested.

This narrative became institutionalized with the emergence of ‘ESG’ (environmental, social, and governance) investment principles. The capitalist planners designed a set of targets that corporations were supposed to voluntarily adhere to – and that investors were supposed to enforce – to make capitalism fairer, more equal, and more sustainable.

Needless to say, it didn’t work. It rapidly became very obvious that ESG principles were extremely easy to game. For example, while many fossil fuel companies didn’t earn the ESG badge, the banks that lent them millions of dollars did.

The problem is that capitalist economies are built to value profit – and profit alone. The thought leaders at Davos could posture about responsible capitalism all they liked, but if ethical practices negatively affected the bottom line, any rational CEO would ditch them before long. And investors wouldn’t argue with this decision – after all, their job is to achieve the highest possible returns.

When oil prices boomed in the post-COVID period, green capitalism was out, and record profits were in.

First, the fossil fuel companies started to quietly ditch their climate goals. Then, the investors followed suit. Just this month, Blackrock exited the Net Zero Asset Managers Initiative, a coalition that requires its members to reach net-zero financed emissions by 2050.

But the end of ethical capitalism has created a problem for the billionaire class: If they couldn’t claim to be responsible stewards of the global economy, why should the world’s workers continue to accept their authority?